Trump’s Tariffs: What They Really Mean for Global Trade and the Emerging Eurasian Century

Introduction: Trump’s Tariffs and the New Trade Battlefield

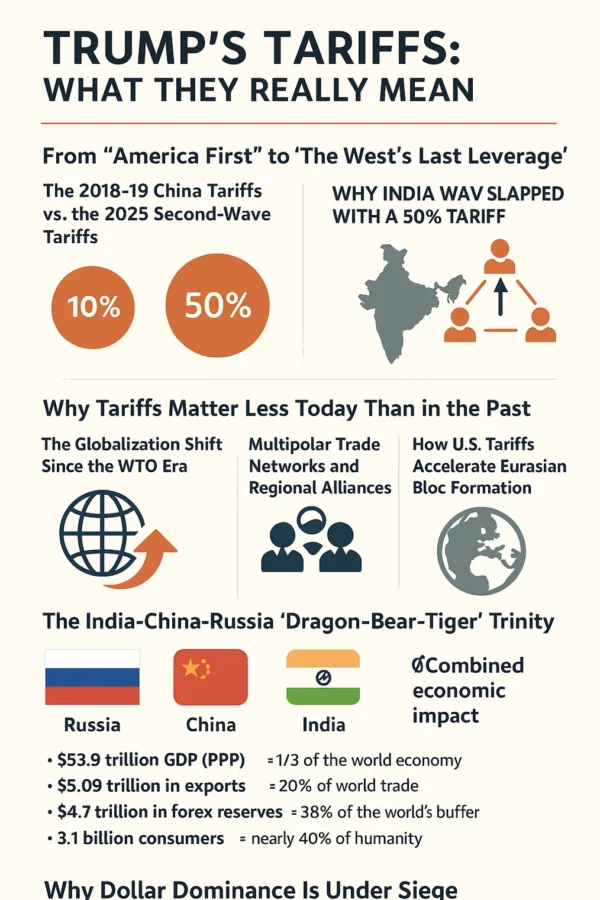

In 2025, former U.S. President Donald Trump’s second wave of tariffs has shaken the world economy. Unlike the 2018–19 tariffs targeting China, this round is broader, geopolitical, and deeply strategic. India has been slapped with a 50% tariff, China faces even harsher penalties, and Russia finds itself indirectly cornered.

But these tariffs are not just about protecting U.S. industries. They are instruments of foreign policy—a last attempt by Washington to preserve global leverage as multipolarity reshapes trade and finance.

From “America First” to “The West’s Last Leverage”

The 2018–19 China Tariffs vs. the 2025 Second-Wave Tariffs

Trump’s first tariffs were narrowly targeted at Chinese goods. In contrast, the new round is designed to pressure multiple countries simultaneously, particularly India and China, while indirectly weakening Russia’s oil-driven influence.

Why India Was Slapped with a 50% Tariff

India is central because of its growing oil trade with Russia. By raising tariffs, the U.S. hopes to cut New Delhi’s energy benefits and discourage its deepening partnership with Moscow.

China’s Manufacturing and U.S. Supply Chain Reshoring

Tariffs on Chinese exports are aimed at forcing U.S. companies to reshore supply chains—a political move, but one that risks accelerating China’s pivot toward Eurasian partners.

Why Tariffs Matter Less Today Than in the Past

The Globalization Shift Since the WTO Era

In the 1980s or 1990s, U.S. tariffs could isolate countries. But in today’s WTO-governed and multipolar economy, exporters have more options.

Multipolar Trade Networks and Regional Alliances

Countries bypass the U.S. through regional supply chains, BRICS+ cooperation, and local currency trade.

How U.S. Tariffs Accelerate Eurasian Bloc Formation

Ironically, tariffs meant to weaken rivals are strengthening Eurasian alliances, binding India, China, and Russia closer together.

The India-China-Russia “Dragon-Bear-Tiger” Trinity

Russia: The Energy Empire

Russia supplies oil, gas, wheat, and uranium at discounted rates, becoming the energy backbone of Eurasia.

China: The Factory of the World

China brings capital, manufacturing expertise, and infrastructure investments.

India: The Service & Consumer Hub

India contributes its booming IT sector, pharmaceuticals, and a growing consumption class of over 1.4 billion people.

The Combined Economic Weight of the Trinity

Together they represent:

$53.9 trillion GDP (PPP) = 1/3 of global economy

$5.09 trillion exports = 20% of world trade

$4.7 trillion forex reserves = 38% of global reserves

3.1 billion consumers = nearly 40% of humanity

Why Dollar Dominance Is Under Siege

De-Dollarization Strategies of Russia, China, and India

Russia sells oil in yuan and rupees, bypassing the U.S. dollar. India and China actively support local-currency settlements.

BRICS+ Settlement Currency and Gold Backing

Talks of a BRICS+ currency, possibly backed by gold, are gaining momentum.

SCO’s Push for Local Currency Settlements

The Shanghai Cooperation Organisation backs non-dollar trade, further weakening U.S. financial dominance.

Top 5 Strategic Consequences of the Tariff-Driven Realignment

(1) Emergence of a Mega Economic Bloc

India-Russia-China now form a bloc capable of countering Western influence in WTO, IMF, and G20.

(2) Currency Wars and the Decline of the Dollar

Tariffs accelerate de-dollarization and boost yuan-rupee-ruble trade.

(3) Defence & Security Dynamics

Russia provides arms, China offers technology, and India offers markets—challenging U.S. and NATO dominance.

(4) Geopolitical Leverage in Trade & Diplomacy

India can negotiate better deals with both the West and Eurasia.

(5) A New Global Order: Multipolarity in Action

For the first time, multipolarity is a reality—not a theory.

India’s Position: From “China+1” to “India+2”

India’s Bargaining Power with Both East and West

India leverages tariffs to gain concessions from both Washington and Beijing.

Modi’s Diplomatic Pivot: SCO and BRICS+

India’s participation in SCO and BRICS+ strengthens its strategic position.

Why India Is the Swing Power of the 21st Century

India’s ability to balance between East and West makes it the pivotal power in the multipolar order.

Trump’s Tariffs as a Catalyst for the Eurasian Century

Energy Routes Shifting Eastward

From the Arctic to Central Asia, trade routes are tilting east.

Defence Alliances Beyond NATO

Russia, China, and India are quietly building an alternative defence ecosystem.

Technology and Supply Chain Realignments

Tariffs force Western firms to relocate supply chains, and India becomes a major beneficiary.

Expert Opinions on the Eurasian Trinity

Manish Bhandari on the Economic Synergy

Manish Bhandari, CIIA & Founder of Vallum Capital, argues that each member of the trinity brings unique strengths. Russia’s energy, China’s manufacturing, and India’s services together form a self-sufficient economic ecosystem. He emphasizes that this convergence isn’t temporary—it signals a permanent restructuring of global trade flows.

Sandeep Pandey on Currency Wars & Defence Deals

According to Sandeep Pandey of Basav Capital, Trump’s tariffs are also about preserving U.S. dominance in defence and finance. By pushing India and China into local currency trade with Russia, Washington inadvertently accelerates the currency war against the dollar.

Avinash Gorakshkar on India’s Strategic USP

Avinash Gorakshkar, SEBI-registered analyst, notes that India’s dual role as a service hub and a consumption market makes it a natural bridge between East and West. Trump’s tariffs, he argues, have given India a stronger reason to deepen ties with both Beijing and Moscow.

Gaurav Goel on India’s Bargaining Advantage

Gaurav Goel of Fynocrat Technologies highlights India’s ability to bargain with China on the Belt and Road Initiative (BRI) and simultaneously maintain energy partnerships with Russia. He calls India the “swing power” of multipolar geopolitics.

Top 5 Reasons Why the India-China-Russia Trinity Is Rising

1. Strength in Unity and Scale

Together, the three nations command $53.9 trillion GDP (PPP), making them nearly one-third of global output. This scale gives them unprecedented bargaining power.

2. Dominance in Exports and Forex Reserves

With $5.09 trillion exports and $4.7 trillion in reserves, the bloc controls 20% of global trade and 38% of world financial buffers.

3. The De-Dollarization Push

By trading in yuan, rupees, and rubles, these nations actively challenge dollar hegemony. Tariffs only accelerate this shift.

4. Rising Defence Power and Security Realignments

India, China, and Russia collectively spend $549 billion on defence, which equals 20% of global military spending. This weakens NATO’s monopoly.

5. Renaissance of Partnerships in a New Global Order

Russia provides energy, China brings capital and manufacturing, and India offers services and markets. This tripod of strengths makes the trinity resilient and future-ready.

FAQs on Trump’s Tariffs and Eurasian Realignment

Q1: What makes Trump’s 2025 tariffs different from those in 2018–19?

A1: The first tariffs targeted China’s trade imbalance, while the second wave is broader and geopolitical, designed to pressure India, China, and indirectly Russia.

Q2: Why did Trump impose a 50% tariff on India?

A2: The U.S. hopes to choke India’s discounted Russian oil trade, thereby reducing Moscow’s energy influence and pressuring India to lean West.

Q3: Are tariffs still effective in today’s global economy?

A3: Not as much. In a multipolar world, countries have alternative trade partners, making tariffs less effective and often counterproductive.

Q4: How are India, China, and Russia bypassing the U.S. dollar?

A4: Through local currency settlements, BRICS+ currency talks, and gold-backed trade mechanisms, bypassing U.S. financial systems.

Q5: Why is India considered the “swing power”?

A5: India benefits from both sides—cheap Russian energy, Chinese investment, and Western supply chain relocations—giving it leverage in multiple directions.

Q6: Will Trump’s tariffs lead to a collapse of globalization?

A6: No. Instead, they reroute globalization toward Eurasian networks, making trade more regionally diversified and less dollar-dependent.

Conclusion: A New Trade Order Beyond Trump’s Tariffs

Trump’s tariffs were meant to preserve U.S. leverage, but in reality, they have backfired by accelerating Eurasian consolidation. India, China, and Russia—each with unique economic strengths—are converging into a strategic trinity that commands one-third of the world economy.

This realignment is not a short-term trend. It is the foundation of a multipolar world, where the dollar is no longer the sole anchor of global trade, and the U.S. no longer dictates the rules unchallenged.

For India, this is a golden moment: it transforms from a balancer to a swing power, shaping the new trade routes of the 21st century. For China and Russia, Trump’s tariffs are the glue binding them closer together.

The bottom line? Trump’s tariffs may be remembered not for protecting America, but for catalyzing the Eurasian Century.

🔗 External Reference: World Trade Organization (WTO) Reports – for latest updates on multipolar trade trends.